- Europe’s largest resource of hard rock spodumene lithium.

- Battery-grade lithium is classified as a ‘Critical’ and ‘Strategic’ material by the European Commission because of its use in batteries

- Classified as a ‘Strategic Project’ by the European Commission in 2025 under the Critical Raw Materials Act

- Sufficient lithium production for at least 0.5 million vehicle battery packs per annum

- By-product production of quartz-feldspar and low grade pegmatite. Feldspar is also designated as a Critical Raw Material

- Responsible production using conventional techniques with a commitment to minimising impact and carbon footprint

- Features two adjacent Mining Leases, one awarded in 2006 for an initial 30-year period and another, which Savannah has the right to purchase, awarded in 2024 for an initial 25 year duration.

- Agência Portuguesa do Ambiente (APA) issued a Positive Declaration of Environmental Impact (DIA) in 2023

- Scoping Study completed in 2023 demonstrated:

- Highly positive economics

- Low technical risk

- Added value from by-products (feldspar/quartz)

- Resource expansion and additional exploration

- Completion of licencing process

- Completion of DFS

- Offtake agreements & Strategic partnerships Final Investment Decision

- Financing & Construction

- Commissioning & Production

- Cash flow generation

- Decarbonisation of project, targeting zero-carbon lithium

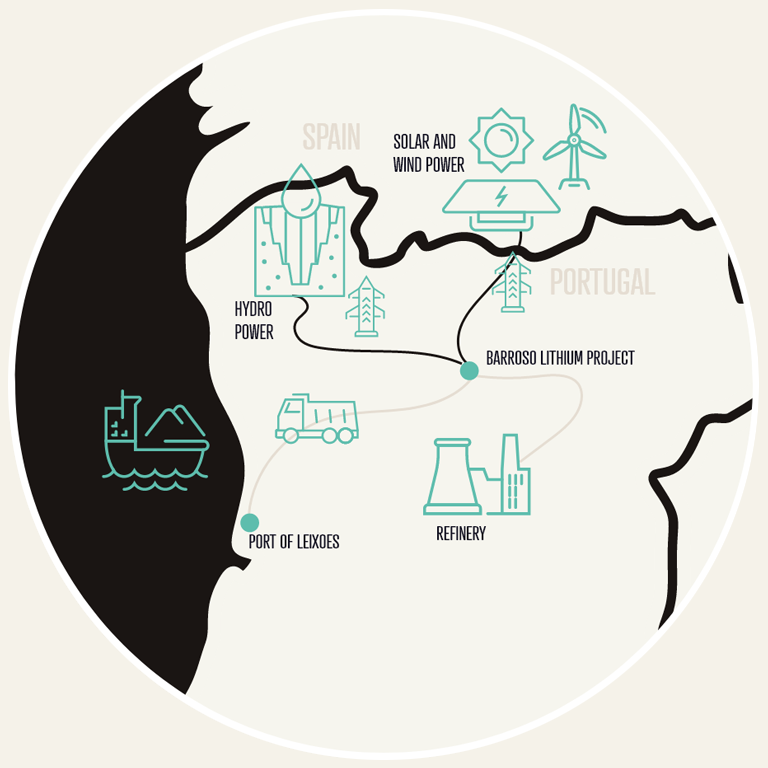

Portugal’s renewable power and existing infrastructure adds to the Project’s potential

- Project located in Northern Portugal, close to the Spanish border

- Portugal's national grid already has c.80% contribution from renewable sources. Savannah is targeting 100& renewable power for the Project.

- After processing, the spodumene lithium concentrate will be transported by truck to a local refinery or to other customers

- 5 deep-water ports located less than 300km away on Atlantic coast.

- Short distance to port reduces carbon footprint for delivered product

Project overview

The Barroso Lithium Project is located in northern Portugal near the town of Boticas and is less than 300km from five deep water ports on the Atlantic coast. Having taken an initial 75% stake in the Project in May 2017, Savannah secured 100% of the Project in 2019 and expanded the Project, adding to the original granted C-100 Mining Lease (5.42km², valid until 2036, extendable for 20 years) with (the right to purchase) the adjacent ‘Aldeia’ Mining Lease (2.74km², valid until 2049, extendable by 20 years).

The Project is now well established as the largest spodumene lithium project in the European Union and was classified by the European Commission as a ‘Strategic Project’ under the Critical Raw Materials Act in March 2025 in recognition of its potential to contribute to the EU's secure supply of strategic raw materials, adhere to environmental, social and governance criteria and demonstrate clear cross-border benefits for the EU.

Based on its spodumene lithium mineralogy and the exploration and development results achieved to date, Savannah believes the Barroso Lithium Project is the closest European analogue to the successful Australian hard-rock lithium projects, which produce highly sought-after spodumene lithium concentrates for international markets.

When Savannah acquired its initial interest in the Project in May 2017, there was no mineral resource estimate on the Project. Since that time, the company has completed over 50,000m of resource-focused drilling and rapidly delineated a JORC Code (2012) compliant resource of 39Mt containing 411,900t of Li2O at an average grade of 1.05% Li2O (1.019 million tonnest lithium carbonate equivalent, “LCE”) across five orebodies as of September 2025. Also of note is the Project’s low iron grade (averaging 0.8% Fe2O3) as this is considered a deleterious element in spodumene lithium concentrates.

As the following table shows, around 68% of the total current ore and contained Li2O resources are classified in the Measured and Indicated categories.

|

Deposit |

Resource category |

Tonnes (Mt) |

Li2O Grade (%) |

Fe203 Grade (%) |

Li2O Contained (t) |

|---|---|---|---|---|---|

| Grandao | |||||

|

Grandao |

Measured |

8.7 |

1.06 |

0.7 |

93,100 |

|

Indicated |

5.0 |

1.03 |

0.8 |

51,100 |

|

|

Inferred |

4.4 |

1.06 |

0.8 |

46,400 |

|

|

Total |

18.1 |

1.05 |

0.7 |

190,600 |

|

| Reservatorio | |||||

|

ReservatoriO |

Measured |

||||

| (WITHIN C-100 LICENCE) |

Indicated |

5.3 |

0.98 |

0.9 |

52,000 |

|

Inferred |

0.8 |

1.10 |

0.9 |

9,200 |

|

|

Total |

6.2 |

0.99 |

0.9 |

61,100 |

|

|

RESERVATORIO |

Measured |

|

|

|

|

|

(UNDER APPLICATION) |

Indicated |

2.8

|

1.02 |

0.9 |

28,600 |

|

|

Inferred |

3.2 |

0.89 |

0.8 |

28,100 |

|

|

Total |

6.0 |

0.95 |

0.9 |

56,700 |

|

RESERVATORIO

|

Measured |

|

|

|

|

|

(WITHIN C-100 LICENCE & |

Indicated |

8.1 |

1.00 |

0.9 |

81,200 |

|

UNDER APPLICATION) |

Inferred |

4.0 |

0.90 |

0.9 |

36,100 |

|

|

Total |

12.1 |

0.97 |

0.9 |

117,300 |

| Pinheiro | |||||

|

Pinheiro |

Measured |

||||

|

Indicated |

2.6 | 1.11 | 0.7 | 28,500 | |

|

Inferred |

2.2 |

1.18 |

0.7 |

23,300 |

|

|

Total |

4.8 |

1.09 |

0.7 |

51,800 |

|

| NOA | |||||

|

NOA |

Measured |

||||

|

Indicated |

0.6 |

1.03 |

0.8 |

6,300 |

|

|

Inferred |

0.1 |

0.95 |

0.5 |

400 | |

|

Total |

0.7 |

1.03 |

0.8 |

6,700 |

|

| Aldeia | |||||

|

Aldeia

|

Measured |

||||

| (UNDER OPTION) |

Indicated |

1.6 |

1.31 |

0.5 |

21,300 |

|

Inferred |

1.8 |

1.29 |

0.4 |

23,700 |

|

|

Total |

3.5 |

1.30 |

0.4 |

45,000 |

|

| All deposits | |||||

|

All deposits |

Measured |

8.7 |

1.06 |

0.7 |

93,100 |

| (EXCLUDING IN UNDER |

Indicated |

15.1 |

1.05 |

0.8 |

159,100 |

| APPLICATION AREA) |

Inferred |

9.2 |

1.11 |

0.7 |

102,900 |

|

Total |

33.2 |

1.07 |

0.7 |

355,200 |

|

|

ALL DEPOSITS

|

Measured |

8.7 |

1.06 |

0.7 |

93,100 |

|

(INCLUDING UNDER |

Indicated |

17.9 |

1.05 |

0.8 |

187,700 |

|

APPLICATION AREA) |

Inferred |

12.4 |

1.06 |

0.7 |

131,100 |

|

|

Total |

39.1 |

1.05 |

0.8 |

411,900 |

*Rounding discrepancies may occur

All of the JORC Resource bearing orebodies on the Project remain open to further resource expansion in multiple directions, and much of the wider Project area remains relatively underexplored to date. Hence Savannah believes that there is significant potential for further resource definition. Some of this additional potential is represented by the supplementary Exploration Targets* which have been estimated for each of the current five orebodies and on a number of prospects across the wider Project area. Following an increase of over 200% against the previous Exploration Target, the latest Target totals 35.0-62.0Mt at 0.9-1.2% Li2O.

TONNAGE RANGE (MT)

|

Deposit |

Lower |

upper |

Li2O % |

|---|---|---|---|

| Reservatorio | |||

|

Reservatorio |

5.0 |

7.0 |

0.9-1.2% |

| Grandao | |||

|

Grandao |

4.0 |

8.0 |

1.0-1.2% |

| Aldeia | |||

|

Pinheiro |

2.0 |

4.0 |

1.0-1.3% |

| All deposits | |||

| Grandao | |||

|

Aldeia Block A |

2.0 |

4.0 |

1.0-1.3% |

|

NOA |

2.0 |

4.0 |

1.0-1.2% |

|

Regional (refer to the following table) |

20.0 |

35.0 |

1.0-1.2% |

|

Total Exploration Target |

35.0 |

62.0 |

0.9-1.2% |

TONNAGE RANGE (MT)

|

Prospect |

Lower |

upper |

Li2O % |

|---|---|---|---|

| ALtos da Urreta | |||

|

Altos da Urreta |

2.0 |

3.0 |

0.7-1.0% |

| Altos dos Cortiços | |||

|

Altos dos Cortiços |

3.0 |

6.0 |

0.9-1.2% |

| Carvalha da Bácora | |||

|

Carvalha da Bácora |

3.0 |

6.0 |

0.9-1.2% |

| All deposits | |||

| Aldeia Block B | |||

|

Aldeia Block B |

7.0 |

10.0 |

0.9-1.2% |

|

Piagro Negro |

1.0 |

2.0 |

0.7-1.0% |

|

Grandão Northwest |

1.0 |

2.0 |

0.7-1.1% |

|

Grandão North |

1.0 |

2.0 |

0.8-1.1% |

|

Aldeia Block C |

2.0 |

4.0 |

1.1-1.5% |

|

Total Exploration Target |

20.0 |

35.0 |

0.9-1.2% |

*Cautionary Statement: The potential quantity and grade of the Additional Resource Targets is conceptual in nature, there has been insufficient prospecting work to estimate a mineral resource and it is uncertain if further prospecting will result in defining a mineral resource

While lithium is the Project’s main focus, it also has the capacity to produce other minerals, such as feldspar and quartz, which are in significant demand from the large ceramic and glass industries present in Portugal and Spain. In support of its plans to produce these minerals alongside lithium, Savannah published its maiden resource estimate for quartz and feldspar in the Grandão orebody in September 2019.

|

Deposit |

Resource category |

Tonnes (Mt) |

Quartz grade (%) |

Mt |

Feldspar grade (%) |

Mt |

|---|---|---|---|---|---|---|

| Grandao | ||||||

|

Grandao |

Measured |

7.1 |

32.6 |

2.32 |

42.8 |

3.05 |

|

Indicated |

6.3 |

34.6 |

2.17 |

42.6 |

2.67 |

|

|

Inferred |

1.0 |

30.9 |

0.30 |

40.3 |

0.39 |

|

|

Total |

14.4 |

33.4 |

4.79 |

42.6 |

6.11 |

Savannah has produced two Scoping Studies on the Project, one in June 2018 and the latest, in June 2023.

As with the 2018 Scoping Study, the lastest Scoping Study is based on a mine and concentrator only development for the production of spodumene concentrate, and reconfirmed the Project has the potential to be a major domestic source of conventional, low cost, low carbon, lithium raw material for Europe.

The 2023 Scoping Study is based on the Mine Plan and Environmental Report which were submitted to the Portuguese regulator in March 2023 and which received a positive Environmental Impact Statement (DIA) in May 2023, and also includes the Aldeia deposit which Savannah has the right to acquire once the related mining licence is issued.

Mine Plan

The Mine Plan for the Scoping Study is based on an annual run of mine rate of 1.5Mt of ore per annum with an estimated life of mine average head grade of 0.96% Li2O (diluted), an overall strip ratio of 5.9:1 (waste:ore ratio) and a 14-year mine life (LOM). It is important to note that this is a scoping study, and the resulting 20.5Mt mine plan cannot be classified as an Ore Reserve under JORC (2012) guidelines.

The concept plan incorporates seven pit stages from the five deposits modelled to date

- Pinheiro (single stage)

- Grandao (2 stages), see Figure 3

- Reservatorio (2 stages)

- NOA (single stage)

- Aldeia (single stage

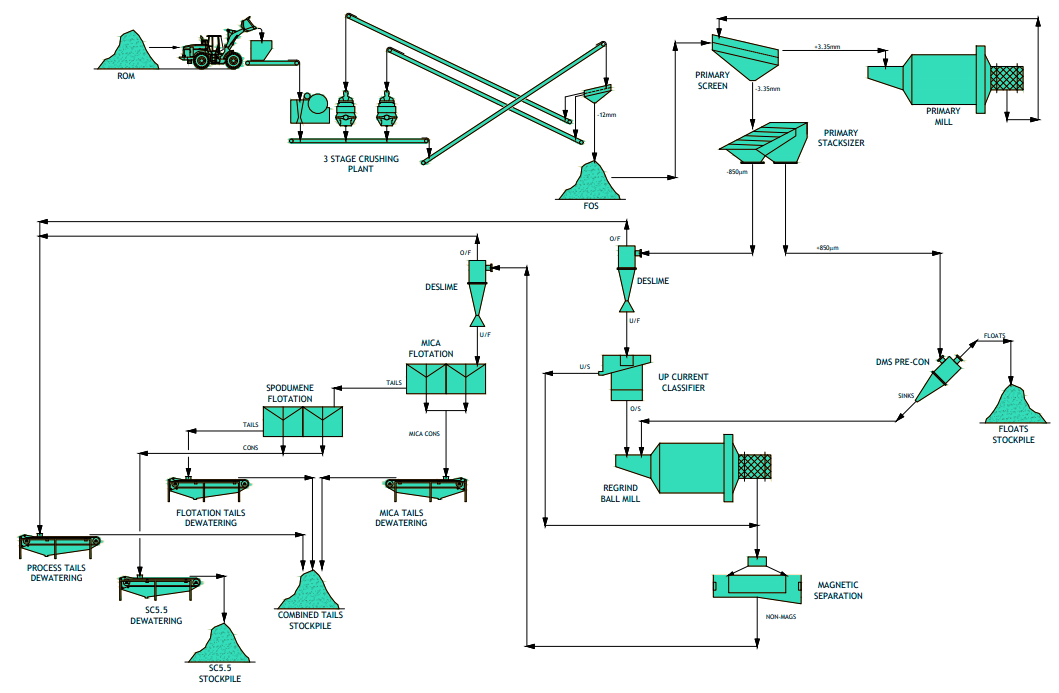

Flow sheet

The Project’s flowsheet, which has been designed and tested to Feasibility Study requirements, combines Dense Media Separation and a flotation circuit utilising environmentally friendly reagents to produce a 5.5% Li2O grade spodumene concentrate. Over the life of the mine, the Scoping Study shows the Processing Plant producing 2.6Mt of 5.5% Li2O grade spodumene concentrate at an average annual production rate of ~191.000tpa.

The tails from the Processing Plant are thickened and dry stacked which eliminates the need for a tailings dam and reduces the overall footprint of the operation. Low-grade pegmatite material that did not form part of the concentrator feed was quantified so that the opportunity of selling this material can be evaluated. The Scoping Study assumes sales of 100,000t/year. The opportunity of producing a ‘Ceramic By-Products’ (feldspar /quartz) from the processing plant tailings for the local ceramics industry was also investigated, and the Scoping Study assumes annual sales of 400,000t.

The 2023 Scoping Study also highlighted the robust economic features and investment appeal of the Barroso Lithium Project.

Economic highlights included a post -tax NPV at an 8% discount rate of US$953 million, IRR of 77% and payback period of 1.3 years based on Life of Mine (‘LOM’) revenue of US$4.2 billion; LOM EBITDA of US$2.8 billion; and LOM post-tax free cash flow of US$1.7 billion.

Price assumptions in the Study included an average 5.5% grade spodumene concentrate LOM price of US$1,464/t and average LOM C1 Operating Cost were calculated at US$292/t of concentrate (including by-product credits).

Initial CAPEX was estimated at US$236 million (excluding contingencies) which included US$40 million for community related measures.

Operating Parameters and Assumptions:

| Mineable resource (June 2023) | |

|

Mineable resource (June 2023) |

20.5Mt at 1.05% Li2O. All open pit. |

| Life of mine strip ratio (waste: ore) | |

|

Life of mine strip ratio (waste: ore) |

5.9: 1 |

| Initial life of mine | |

|

Initial life of mine |

14 years at 1.5Mtpa throughput rate |

| Processing route & recovery rate | |

|

Processing route & recovery rate |

Crush-grind-Dense Media Separation-flotation (73% recovery) |

| Concentrate production & spec | |

|

Concentrate production & spec |

191ktpa (minimum), 5.5% Li2O grade spodumene concentrate |

| Concentrate production as LCE/lithium hydroxide equivalent (net of assumed processing losses in a chemical conversion plant) | |

|

Concentrate production as LCE/lithium hydroxide equivalent (net of assumed processing losses in a chemical conversion plant) |

25ktpa; 29ktpa. Sufficient for 0.5M 60kWh car battery packs per annum |

| Coproducts | |

|

Coproducts |

400,000tpa of Ceramic By-product (Feldspar/quartz); 100ktpa of low grade pegmatite |

| Intial capex | |

|

Intial capex |

US$236m (excluding contingencies and including US$40m of community related measures) |

| Sustaining capital & closure costs | |

|

Sustaining capital & closure costs |

US$49m |

| LOM C1 cash operating cost (US$/t CONC) | |

|

LOM C1 cash operating cost (US$/t CONC) |

US$292/t. C1 operating costs include all mining, processing, transport, G&A and community costs, and are net of ceramic by-products credits and exclude royalties |

It is Savannah's intention to design and operate the Barroso Lithium Project in a way which minimises its impact on the natural environment and, while maximising the benefits to local communities and society, ensures its lithium product carries a minimal carbon footprint into the lithium battery supply chain.

To complement the highly comprehensive Environmental Impact Assessment submitted on the proposed development to Agência Portuguesa do Ambiente, (APA), the Portuguese Environmental Agency, Savannah announced the initiation of a decarbonisation strategy for the Project in March 2022. Working with leading consultants and service providers in the field, Savannah is committed to moving towards reducing the Scope 1 and 2 emissions at the Barroso Lithium Project to net zero once in production and, ultimately, to a position of net zero life-of-project, and targeting the reduction of its Scope 3 emissions in collaboration with its future customers.

Savannah provided an update on the initial phase of Study in February 2023 which confirmed that Battery Electric Mining Equipment will provide the most effective and flexible means to reduce Scope 1 emissions at the Project to zero (Scope 1 emissions represent 68% of the Scope 1 and 2 total). The initial study phase also found that the estimate of Scope 2 baseline emissions has been reduced by 54% from the original 2019 forecast, based on the potential for a reduction in the estimated power requirement of the Project's plant and a 41% reduction in the emissions associated with Portugal's grid power (In 2021, 62.2% of Portugal's grid power was generated from renewable sources).

Based on these initial findings, future work on the decarbonisation of the Project will include; more detailed analysis of the options available to Savannah to secure 100% renewable power to the Project and studies with a number of mining equipment OEMs to determine a site specific solution for a transition to battery operated mining fleet and associated charging infrastructure.

Offtake & Partnerships

Savannah entered its first strategic partnership with the AMG Critical Materials N.V. Group ('AMG'), the Amsterdam-listed, global critical materials business in June 2024. AMG is an established spodumene concentrate producer at its Mibra mine in Brazil and the first major European lithium chemical producer at its lithium hydroxide plant in Bitterfeld-Wolfen, Germany. Key elements of the Savannah-AMG partnership are:

- A GBP16m investment by AMG in Savannah (at a price of 4.67p, representing a 35% premium to the 30-day VWAP at the time) to become Savannah's largest shareholder (currently 15.7%).

- An offtake heads of terms agreement (the 'Offtake HoT') through which, once final agreements are negotiated and signed, AMG can purchase 45ktpa of spodumene concentrate from the Project (approximately 25% of total) for 5 years based on prevailing market prices at the time.

- AMG will take a lead role in the partnership in securing a 'full project financing solution' for the Project's development. If such financing is successful, the Offtake HoT anticipates the increase and extension of the offtake arrangements to 90ktpa for 10 years.

- A Co-operation agreement under which AMG and Savannah will work together on a number of mutually beneficial opportunities including a study for joint construction of a feldspar/spodumene pilot plant in Portugal and a study for the construction of a Spodumene-to-Lithium Carbonate refinery in Portugal or Spain.

This agreement leaves Savannah with most of its future spodumene concentrate production unallocated. This could be sold to an additional partner or on to the open market.

Financing

Savannah will secure the finance required for the Project’s construction once it has taken a Final Investment Decision in 2026. Potential elements within the overall financing package may include Project Finance loans, finance from offtake and strategic partners, EU/Government sourced finance, and equity.

To date, the supply of lithium to Germany through Savannah's offtake Heads of Terms with AMG for 90ktpa spodumene concentrate for 10 years has led to potentially significantly financing assistance from the Germany Government. In December 2024, Euler Hermes AG, the export credit agency acting for the German Government confirmed in a non-binding Letter of Interest, the ‘eligibility in principle’ of the Project for an ‘Untied Loan Guarantee’ (UFK) on a loan up to USD 270 million (capped at 60% of Project CAPEX). 80% of a UFK-covered loan would be guaranteed by the Federal Republic of Germany making an attractive basis for a Project Finance loan from Germany's KfW IPEX-Bank and / or other banks.

The Company is now working with KfW IPEX and Euler Hermes to progress this opportunity.

In addition, the Company appointed Cutfield Freeman & Company Limited ('CF&Co') as its Project Finance Advisor ('PF Advisor') in July 2025. By making this appointment, Savannah is maintaining its commitment to the rapid development of the Project so that the Company is well placed to leverage the favourable lithium market dynamics which are expected in the coming years. CF&Co will support Savannah in the development and implementation of Savannah's funding strategy, which includes the offtake heads of terms agreement with AMG and the non-binding Letter of Intent on the potential loan guarantee from Euler Hermes AG acting for the German Government.

As referred to above, in addition to the 5 current JORC Resource orebodies, the Project features numerous other pegmatite targets. These can create a pipeline of opportunities to increase the Project’s existing resources over time.

For example, on the C-100 Lease, assays from rock chip samplings at Carvalha da Bacora and Altos dos Cortiços have included:

Carvalha da Bacora: 1.75% Li₂O; 1.66% Li₂O; 1.5% Li₂O; 1.46% Li₂O

Alto dos Cortiços: 3.01% Li₂O; 1.9% Li₂O

While on the Aldeia Block B, multiple new lithium bearing pegmatites have been identified with assays including 2.11% Li2O (rock chip) and 14m @ 1.01% Li2O, 6m @ 1.39% Li2O, 4m @ 2.62% Li2O and 4m @ 2.08% Li2O from channel samples.

Mainland Europe currently consumes around one quarter of the world’s lithium and is the second largest market for EVs behind China. With battery production by major European manufacturers expanding to meet the goals of the energy transition, any potential domestic sources of lithium raw material have become strategically important and will be much in demand.

The European Commission has classified battery grade lithium as both a ‘Critical’ and ‘Strategic’ material, while the Critical Raw Materials Act features the target that at least 10% of Europe’s demand for critical raw materials such as lithium should be met from domestic supplies. This backdrop creates a great opportunity for Savannah as it looks to establish itself as a responsible, long-term, domestic supplier of lithium in support of Europe’s targets of creating a net-zero carbon economy and greater energy independence.